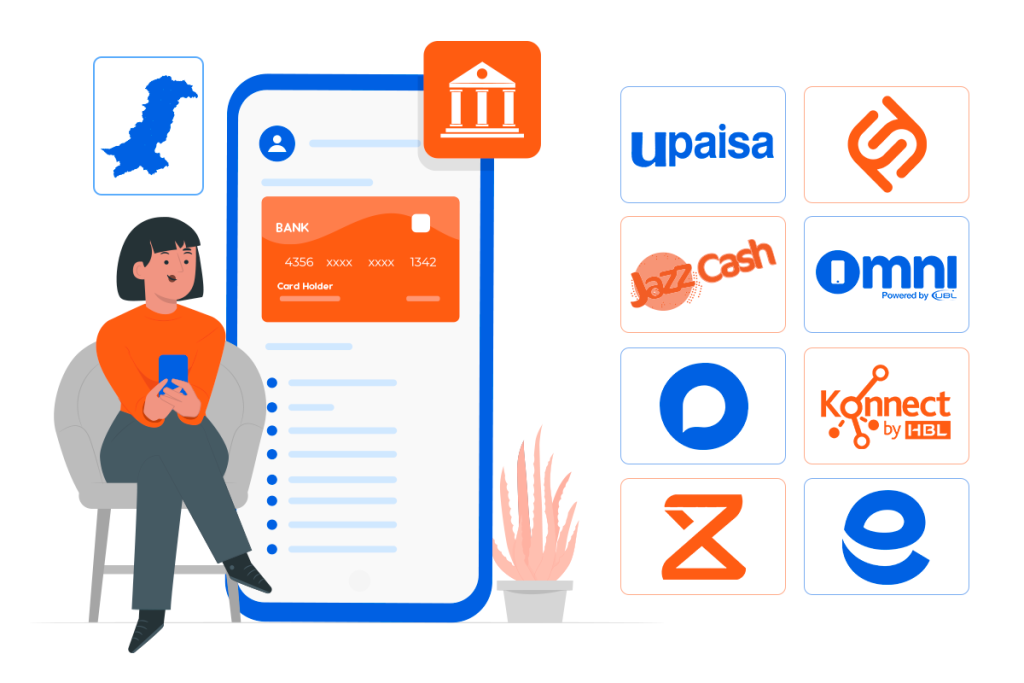

Banking is changing all over the world, including in Pakistan. People want easy, convenient, and secure ways to handle their money. In Pakistan, mobile payments are becoming really important because they make things much easier. The Best Digital Banking Apps in Pakistan are a big part of this change, and in this article, the Tashheer research team will thoroughly discuss the top mobile wallets in Pakistan, giving you essential insights and information to help you smoothly navigate this digital transformation. Tashheer Digital’s analysts made this list after considering on App user experience, Uptime, Agent’s network, Payment options (utility bills, govt payments, bank transfer, mobile credit, travel, education, entertainment), and Daily Limit. Join us as we sort through these variables to determine the best options for e-payment in Pakistan.

These apps have made digital payments accessible and convenient for millions of Pakistanis thanks to their innovative features, user-friendly interfaces, and wide range of services. As the need for digital payments grows, these mobile wallet apps will play an even more important part in Pakistan’s economic situation in the future.

List of 8 Best Online Wallet Apps in Pakistan

Presenting the elite selection of the finest online wallet apps in Pakistan:

| Mobile Wallet App | Launched | Founder | Head Office |

| EasyPaisa | 2009 | Telenor Microfinance Bank | Karachi, Pakistan |

| Jazz Cash | 2016 | Jazz Pakistan | Islamabad, Pakistan |

| NayaPay | 2017 | Danish Lakhani | Lahore, Pakistan |

| SadaPay | 2019 | Brandon Timinsky | Islamabad, Pakistan |

| UPaisa | 2013 | U Microfinance Bank & Ufone | Islamabad, Pakistan |

| UBL Omni | 2010 | United Bank Limited (UBL) | Karachi, Pakistan |

| Konnect by HBL | 2021 | Habib Bank Limited (HBL) | Karachi, Pakistan |

| Zindagi | 2022 | JS Bank Limited | Islamabad, Pakistan |

EasyPaisa

Easypaisa is a Mobile Wallet and Banking service from Pakistan. It started in October 2009 with Telenor Pakistan. They let you make digital payments using a QR code, and they are the only mobile money service in Pakistan certified by GSMA. Initially, Easypaisa was only used for money transfers via USSD. They launched a smartphone app for additional financial transactions in 2016. It is a subsidiary of Telenor Microfinance Bank which Telenor Group and Ant Group jointly own. Telenor Group is a massive telecommunications company with 186 million customers. Ant Group, linked to Alibaba Group, runs Alipay, a leading digital lifestyle platform. Recently, on January 17, 2023, Easypaisa started offering a debit card.

App Features

Tashheer has compiled a comprehensive list of prominent features available in the Easypaisa app, outlined below.

Money Transfer

- Banks

- Easypaisa

- CNIC

- Raast

- Send Tohfa

Mobile Services

- Mobile Load

- Mobile Packages

For Business

- Retailer

- Merchant

Payments

- Pay Utility Bills

- Send Donations

- Subscribe to Insurance Plans

- Scan QR

- Get Discounts

- Vouchers and Promo code

- Top-up

- Buy Tickets

My Account

- Add Funds

- Create Asaan Digital Account

- Subscribe to Savings Plan

- Play Games

- Easypaisa Debit Card

- NewGen Account

- Shops

- Upgrade Your Account

JazzCash

JazzCash, formerly MobiCash, is a Pakistani company offering mobile wallets, mobile payments, and branchless banking services. Mobilink (now Jazz) introduced it in 2012, partnering with their subsidiary, Mobilink Microfinance Bank. Holding a significant 64 percent market share in mobile money activity, JazzCash is a key player in the industry. In addition, JazzCash collaborates with Masterpass to provide a digital payment service using QR co JazzCash started in 2012 as MobiCash, a partnership between Mobilink (now Jazz) and Waseela Bank, later renamed Mobilink Microfinance Bank. In 2016, it became JazzCash. In 2020, JazzCash teamed up with Payoneer to help freelancers. Now, they can take money from their Payoneer account using JazzCash. Over 100,000 such accounts are now connected to JazzCash.

App Features

- Freelance Payments

- JazzCash NextGen

- Deposit Money

- Money Transfer

- Goama Games

- Debit Card

- JazzCash Virtual Card

- ReadyCash

- QR Payment Discounts

- Bill Payment

- Mobile Load

- Mobile App

- Bundles

- KAIOS

- Multi-payments

NayaPay

Nayapay is a State Bank of Pakistan (SBP) licensed EMI-registered online payment gateway. It provides customers with daily transactions such as e-money and banking services such as cash transfers, debit cards (actual and virtual), and other bill payment services. Customers can use the Nayapay app to pay their bills, send money to relatives and friends, and make purchases using their Visa debit card. Merchants can use digital wallets to take payments, execute transactions, and raise funds. Nayapay has announced the launch of Arc Intro, a digital transaction platform for small and medium-sized businesses. It will be a ground-breaking platform and financial management solution for small businesses. The Bank of Punjab has collaborated with NayaPay as one of its partner banks.

App Features

According to the Tashheer Accounts team, NayaPay classifies its services into two categories.

Personal

- Wallet Creation

- Adding Money

- Visa Debit Card

- PayPak Debit Card

- Sending Money

- Account Management

- Charges

- Adding & Removing Friends

Business

- Accepting Payments

- Invoices and Payment Links

- Transactions

- Wallet

- POS

- Internet Payment Gateway

- Visa Card

- Deposits

- Refunds and Chargebacks

- Designated Bank Accounts

- 3D Secure Authentication

- Pricing: Fees and Allowance

SadaPay

Established in 2019, SadaPay quickly gained fame for its premium services. It stands out as a digital mobile wallet (E-Wallet) in Pakistan, providing fast and safe online transactions for freelancing, e-commerce, bill payments, and more, with graphically appealing debit and Master cards. SadaPay streamlines procedures like cash withdrawals and subscription purchases. Notably, the SadaPay card can be used anywhere MasterCard is accepted, including famous online platforms such as Netflix, Amazon, AliExpress, and Spotify. SadaPay’s dedication to innovation and accessibility has made it a popular choice among Pakistani customers, allowing them to handle their finances conveniently and securely.

Services

SadaPay, a prominent mobile wallet and branchless banking service in Pakistan provides users with an extensive range of financial services. Here is a list of the key services offered by SadaPay:

- Send and Receive Money

- Mobile Top-Ups

- Bill Payments

- International Transfers

- Online Payments

- Cash In and Cash Out

- Account Management

- Virtual Card

- SadaPay Biz

- Financial Education

UPaisa

Ufone and U Bank’s UPaisa mobile wallet offers a range of financial transactions. Simply sign up using your cellphone number, download the UPaisa app, and verify your identity to set up your account. Load funds into your UPaisa wallet through Ufone service centers, UBank branches, or Ufone scratch cards. It is a secure and convenient way to send and receive money, pay bills, top-up mobile phone airtime, and make online payments. UPaisa is widely accepted across Pakistan, with over 10 million active users. UPaisa transactions are typically cheaper than traditional banking methods. The UPaisa app is available for free on the Google Play Store and Apple App Store.

Services

- Open UPaisa Wallet

- Mobile Recharge

- Bill Payments

- Money Transfer

- UPaisa Debit Card

- Insurance

UBL Omni

UBL Omni is a comprehensive mobile banking app and branchless banking service launched by United Bank Limited (UBL), one of Pakistan’s largest commercial banks. It offers a wide range of financial services, including money transfers, bill payments, mobile top-ups, merchant payments, account management, and more. Omni Mobile Accounts function as real bank accounts, operating similarly to traditional bank accounts. They are available to all clients who have a registered SIM card and CNIC. Your Omni Account number is linked to your registered mobile number associated with your CNIC. Opening an Omni Account is simple and may be done at any Omni Agent or UBL Branch.

Services

- Mobile Recharge

- Bill Payments

- Money Transfer

- Send Money to CNIC/Person

- IBFT

- Scan & Pay (OR Code)

- Merchant payments

- Shop online

Konnect by HBL

Konnect by HBL is a mobile wallet app that is owned by Habib Bank Limited (HBL), one of the largest commercial banks in Pakistan. HBL is a publicly traded company, and its shares are listed on the Pakistan Stock Exchange (PSX). Their goal is to simplify banking processes. Users can effortlessly make direct payments, send money, and pay bills. A notable feature is the Konnect Shop facility, enabling users to conveniently deposit and withdraw money from any HBL Konnect Shop throughout Pakistan. They also use the latest security technology to protect user data and transactions. The app is also PCI DSS compliant which means that it meets the highest standards for security in the payment industry.

App Features

- Account Opening

- About Konnect

- Gulak

- Send Money

- Packages

- Konnect Debit Card

- Konnect QR Payments

- Home Remittance

Zindagi

Zindagi helps you manage your money better with a bunch of useful features right on your phone. They aim to be the most innovative, customer-centric, and responsible digital banking experience in Pakistan. You can spend money online and in stores, trade, get free international payments, and customize your app themes. It is not just an app but it is a better lifestyle and a new way of living with Zindagi. Your Zindigi account gives you instant spending notifications, smooth cash flows, hassle-free travel, and real people support through In-App chat. Advanced fraud detection systems of this app monitor your transactions to identify and prevent fraudulent activities.

App Features

Here is the list of standout features of the Zindagi app:

- Send Money

- Payments

- Mobile Load

- Order Card

- Mutual Funds

- Stocks

- Z-Miles

- Loans

Final Words

These top eight mobile wallet apps researched by Tashheer are changing the way people handle money in Pakistan. They are like helpful tools that make it really easy and safe to do things like sending money or paying bills. These apps have revolutionized the way people send and receive money, pay bills, and shop online, offering a secure and accessible alternative to traditional banking methods. Each app has its own cool features, showing that a growing number of individuals want simple and secure ways to manage their money. As technology advances, these apps will likely become even more important for everyone in Pakistan. They are like the superheroes of money management, making everyone’s life easier and more convenient.