Pakistani freelancers earned $397.3 million through exporting their services in 2021-22, according to the State Bank of Pakistan. A global survey found that freelancers charge an average hourly rate of $28, showing noteworthy earning potential, particularly in developing countries. Freelancers have unique financial needs due to their variable income and international clients. They need banks that can handle cross-border transactions and provide access to multiple currencies without high fees. The ideal bank for freelancers in Pakistan should offer tailored solutions to address these challenges.

Due to PayPal unavailability in Pakistan, Freelancers should find alternative and better solutions to withdraw their money to Pakistani bank accounts. However, there are alternate ways which you can adopt to make Paypal account in Pakistan and can use for international transactions. To simplify your decision-making process, our Tashheer research team compiled an in-depth guide that explores the top 8 banks serving freelancers, highlighting their unique features and benefits.

How Do you Open a Freelancer Bank Account?

Many banks allow you to open a freelancer account online or through their mobile app. You may also be able to visit a branch in person. Here are some steps that explain how to open a Freelancer Bank Account:

Read more: How Freelancing is Shaping Digital Economy in Pakistan

To open a bank account for freelancing:

Choose the Right Bank

Gather Documents

Schedule an Appointment

Pick the Account Type

Explore Extras

Stay Financially Responsible

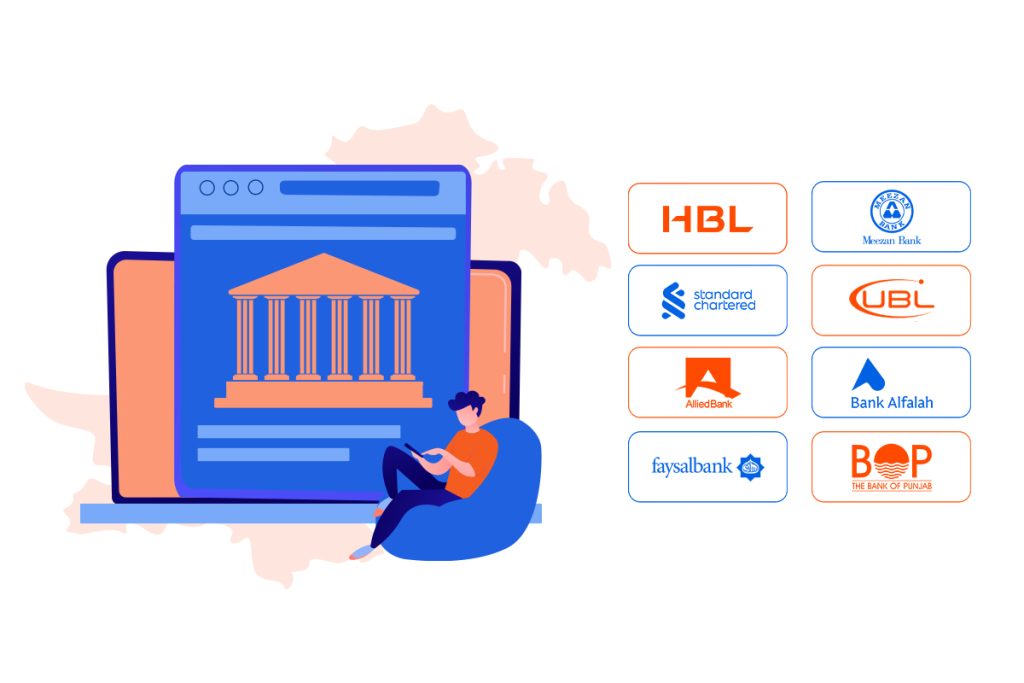

List of 8 Preferred Banking Options for Freelancer Account in Pakistan

Here is the list of 8 best banks for freelancers in Pakistan, listed as:

Meezan Freelancer Account

Meezan Bank is Pakistan’s largest Islamic bank and is a publicly listed company with a paid-up capital of Rs. 17.91 billion. Meezan Freelancer Account is a Rupee or Foreign currency-based personal account offered as both Savings and Current variants and has been designed solely for freelancers. Freelancer community can now easily receive their work remittances and payments directly into their accounts and enjoy countless benefits of a full-fledged account.

Key Features

- Free Cheque book and Pay Orders

- Free Online Branch Banking

- Attractive Conversion Rates

- Free Mobile Banking App

- Inward Foreign Remittance

- Opportunity to Invest in Certificate of Islamic Investments (COIIs) of Meezan Bank

- Tax facilitation services by Befiler at discounted rates

- 50% waiver on processing fee for Car Ijarah, Meezan Solar, and Apni Bike

- Exclusive discounted pricing on consumer products (Car Ijarah and Meezan Solar)

- Collaboration with Pakistan Freelancers Association (PAFLA)

HBL Freelancer Digital Account

HBL was Pakistan’s first commercial bank, founded in 1947. HBL has expanded its branch network, maintaining its position as the largest private sector bank in Pakistan, with 1,750+ branches and 2,200+ ATMs worldwide, serving over 36 million customers. HBL now offers freelancers accounts to receive their work payment through Freelancer Digital Account and Linked Exporter’s Special Foreign Currency Account (ESFCA). You can open an HBL Freelancer Digital Account by simply visiting the HBL Website or through a Branch by showing yourself as a Freelancer.

See more: A Complete Guide to PayPal and its Alternatives in Pakistan

Key Features

- A Freelancer Account is presented as a Current account only.

- Only for individuals of 18 years and above.

- The account is opened in Pak Rupee with an option to link an Exporter’s Special Foreign Currency Account for retaining foreign currency.

- It is exclusively available for New to Bank (NTB) customers.

- The account can be opened through SNIC/CNIC.

- There’s no minimum monthly balance requirement.

- A free PAYPAK debit card is provided for the first year, with subsequent year charges as per prevailing SOBC.

- The account opening process is simple and self-service.

Standard Chartered Freelancer Digital Account

Standard Chartered Freelancer Saadiq Asaan Account is a Shariah-compliant current account made for freelancers and small business owners to simplify banking. By opening this digital account, Freelancing can receive their overseas freelancing payments easily into your accounts. For more details related to banks for international transactions you can read our article on Elevate Your International Transactions with These Top 6 Banks in Pakistan. Freelancer account currency is available in PKR, USD, GBP, and EUR for greater flexibility You can even withdraw cash of PKR 500,000 per day or equivalent and a monthly debit and credit limit of USD 5,000 or equivalent. It is available in both Variants, Conventional, and Saadiq.

Key Features

- Freelancers can open and maintain the account without worrying about minimum balance constraints.

- Enjoy free ATM withdrawals across all Standard Chartered Bank ATMs in Pakistan.

- Avail the checkbook facility for efficient business transactions.

- Transfer funds to other Standard Chartered accounts in Pakistan without incurring charges.

- Freelancers can enjoy these benefits with no monthly account fee

- Shariah-Compliant: The account adheres to Islamic principles, ensuring compliance with religious beliefs.

Faysal Bank

Faysal Bank was established in 1994 with the single aim of helping people and businesses grow financially. It has over 720+ branches across 274+ cities in Pakistan. Faysal Bank Roshan Digital Account and Faysal Islami Burraq Digital Freelancer Account stand out for their versatility in serving to non-resident Pakistanis and residents. It is developed to help Pakistani freelancers directly receive payments into their personal bank accounts digitally, quickly, and conveniently.

Key Features

- Effortlessly manage finances from anywhere which is crucial for freelancers dealing with international clients.

- Minimal fees include no monthly maintenance fees, minimum balance requirement, or online banking charges.

- Transfer funds instantly between your Payoneer and Faysal Islami accounts.

- Supports multiple currencies, facilitating transactions in various global currencies.

- Enables unlimited transactions without restrictions.

- Easily transfer funds through various options including online banking and SWIFT transfers.

- 24/7 Customer Support

UBL Freelancer Account

UBL works as one of the leading banking and financial services sectors in Pakistan with over 1,360 branches and 1,440 ATMs with UBL Omni spread all over the country. UBL Freelancer account is a non-remunerative or current account, a Pakistani Rupee checking account, designed specifically for freelancers in Pakistan, engaged in the provision of any digital services including IT and IT-related services, against which payments are received from outside Pakistan. The documentary requirements for freelancers only include a Copy of the original CNIC and Export Agreement. The bank offers freelancers the chance to open an ESFCA (Exporter’s Special Foreign Currency Account), allowing them to retain a portion of their freelancing income in foreign currency. Read more about 5 Easy Ways to Send Money Outside Pakistan.

Key Features

- Simple Account Opening Documentation

- Instant Account Opening Journey

- Availability of Exporter Special Foreign Currency Account

- Preferential FX Rates

- Free General Banking Services

- Rate Break on Loans

- Discounts on Co-working Spaces

- Discounted Tax Facilitation

- Collaboration with Freelancers Association

Allied Freelancer Account

Allied Bank is the 5th largest commercial bank in Pakistan and is a subsidiary of the Ibrahim Group with over 1,500 branches and a registered office in Lahore. Allied Freelancer Account is designed specifically to meet the financial and banking needs of Pakistani Freelancers, offering streamlined banking solutions. This is the combo account of the most economic, innovative, and unique features that provide the best solution for freelancers. You can open an Allied Freelancer Account with ease and comfort while using a digital platform (ABL Website), myABL application, or by visiting the nearest ABL bank branch.

Key Features

- No minimum balance requirement

- Quick and easy account opening process

- Free online banking transactions from the branch counter for the current account variant

- Free access to E-statement

- Smooth inward foreign remittance process

- Free access to 24/7 mobile application and WhatsApp banking

- Available in both current and saving variants

- Bi-annual profit payout for saving category account

- Availability of PKR Visa Debit Card with various features (Charges apply as per SOC)

BOP Freelancer Digital Account

Bank of Punjab is the largest Commercial Bank of Pakistan that was established in October 1989 and headquartered in Lahore, Punjab, Pakistan. It operates domestically and internationally, holding AA ratings from the Pakistan Credit Rating Agency (PACRA). BOP Freelancer Digital Account is a non-profit current account designed specifically for Pakistani residents and independent workers who want to open their digital accounts without any hassle of visiting BOPbranch. To open the account, you will need to satisfy some identification requirements as per regulatory instructions and bank internal policies.

Key Features

- Initial Balance requirement: Nil

- Unlimited Monthly Transactions

- Account opening on minimum documents

- Applicable taxes including WHT, FED, and Zakat as per existing law on deposit products.

- Exporters’ Special Foreign Currency Accounts (ESFCAs) linked to primary PKR accounts allow you to retain USD 5,000 per month or 50% of your export proceeds, whichever is higher.

- Manage your account online and access your funds 24/7.

- The target market shall include independent workers who earn payment on a per-job or per-task basis, usually for short-term freelancing work.

Bank Alfalah Freelancer Digital Account

Bank Alfalah is one of Pakistan’s largest private banks with over 890 branches across 200+ cities nationwide. Now, Pakistani freelancers can quickly receive their online work payments from anywhere in the world directly from their FCY and PKR bank accounts. Just like their work, freelancers can easily open a Bank Alfalah Freelancer Digital Account from comfort of their workplaces, homes, or anywhere else to conveniently meet their banking needs. It comes in both current and savings variants, allowing you to choose based on your needs for interest and transactions. Through opening this account, they can earn handsome monthly returns and conveniently fulfill their banking needs.

You may also like: Top Mobile Banking Apps in Pakistan

Key Features

- Primary FDA account opened in PKR

- Exporters can open ESFCA in USD to retain export proceeds in USD

- Freelancers can retain up to $5,000 or 50% of export proceeds (whichever is higher) in ESFCA

- Funds in ESFCA can be converted to PKR upon request

- ESFCA balances can be used for personal and work-related payments without SBP approval

- Bank Alfalah Debit Card issued for PKR and FCY accounts

- Free SMS alerts for all ADC transactions

Final Words

Choosing the right bank to open your freelancer account in Pakistan can have a noteworthy impact on your financial management and growth. In this research article, our Tashheer research team compiled a list of 8 Best Banks for Freelancers in Pakistan. With a variety of options available, each with its own set of features and benefits, it is important to consider your specific banking needs. Whether you prioritize low fees, international transactions, or a user-friendly mobile app, there is a bank out there that is a perfect fit. Choose the bank that aligns with your goals and helps you to ease your journey of efficient financial success.