Transferring money outside the country has been challenging for Pakistanis for so many years. Whether you want to send funds to your family members abroad, pay for international purchases, or you want to receive payments for freelance work, cross-border transactions have always been challenging. In today’s digital age, online payment methods have become important for individuals and businesses at the same time. PayPal is one of the most popular platforms for sending and receiving money globally. However, setting up a PayPal account in Pakistan has been a challenge due to certain restrictions. In this guide, Tashheer expert team will take you through the process of creating a PayPal account in Pakistan and explore some alternatives for your convenience. If you’re interested in exploring more options for international transactions, consider checking out our guide on Elevate Your International Transactions with These Top 6 Banks in Pakistan.

Simple PayPal Guide and its Benefits

PayPal is like a digital platform that helps you buy things online or send money to friends and family. It is a popular way to pay for things without using cash or credit cards directly. In short, PayPal is a safe, convenient, and versatile way to manage your money online. Whether you’re shopping, sending money to loved ones, or running an online business, PayPal makes transactions easy and secure. Here’s how it works and why it is helpful. If you’re interested in exploring other mobile wallet apps, check out our list of the Top 8 Mobile Wallet Apps in Pakistan

How PayPal Works

Here is the simple breakdown of how PayPal works for you:

Sign Up

Link Your Bank or Card

Shop Online

Send Money

Benefits of PayPal

Safety and Security: PayPal keeps your financial information private. When you pay with PayPal, the seller doesn’t see your credit card or bank details, reducing the risk of fraud.

Convenience: It’s super convenient to pay with PayPal. You don’t need to enter long details of your card every time you make a purchase online. Just log in to your PayPal account, and you’re good to go.

International Transactions: PayPal works globally, so you can use it to buy stuff from overseas or send money to friends and family abroad. It’s a convenient way to deal with international transactions.

Buyer Protection: PayPal offers buyer protection, which means if something goes wrong with your purchase like you don’t receive the item or it’s not as described, PayPal can help you get your money back.

Easy to Use: PayPal is user-friendly. The interface is simple, and the whole process of sending money or making payments is straightforward.

Why PayPal Isn’t Available in Pakistan?

PayPal is a popular online payment service. It is not available in Pakistan. But why? Well, the main reason is that PayPal has certain rules and regulations it follows before starting its services in a new country. Pakistan might not meet all of these requirements. Here are some of the reasons, compiled by Tashheer research team, leading to PayPal unavailability in Pakistan.

1- Money Laundering and Fraud

One big concern is the risk of money laundering and fraud. PayPal needs to make sure that the country it’s operating in has strong enough regulations to prevent these problems. If they don’t feel confident about this, they might hesitate to start in that country.

2- Local Banking System

Another issue might be the local banking system. PayPal needs to work closely with banks in a country to transfer money smoothly. If the banking system in Pakistan doesn’t meet PayPal’s standards or isn’t very compatible with their technology, it could be another reason why they’re not interested in starting operations there.

3- Market Size

Sometimes, it’s also about the size of the market. If PayPal doesn’t see enough potential customers in Pakistan or if the market is too small compared to the effort it takes to set up operations, they might decide it’s not worth it for them.

Challenges Faced by Freelancers in Receiving Money Outside the Country

Freelancers, who work independently and often remotely, face several challenges when it comes to receiving payments from clients outside their own country. Here are some common hurdles they may face:

Payment Methods

Many clients prefer to use payment methods that are convenient for them but may not be accessible or compatible for freelancers. For example, some clients might prefer bank transfers, which can be slow and expensive for freelancers due to international transaction fees and currency conversion costs.

Currency Conversion

Dealing with different currencies can be tricky for freelancers. Converting money from one currency to another often includes fees and unfavorable exchange rates, leading to reduced earnings of the freelancers.

Payment Delays

International payments can take longer to process compared to transactions within the country. Freelancers experience delays in receiving payments, affecting their cash flow and financial stability.

Banking Restrictions

Some countries have restrictions on receiving foreign currency and also impose limits on international transactions. Freelancers always encounter difficulties in accessing their funds due to these banking regulations.

Payment Security

Freelancers may face risks associated with online payment security, such as fraud or unauthorized transactions. Without proper safety practices, they face financial losses in their incomes.

Creating a PayPal Account in Pakistan

While PayPal doesn’t officially offer its services in Pakistan, there are still ways to create an account and use its features. Here’s a step-by-step guide:

VPN

Visit PayPal’s Website

Choose Account Type

Enter Personal Information

Verify Email

Link a Card or Bank Account

Confirm Identity

Start Using PayPal

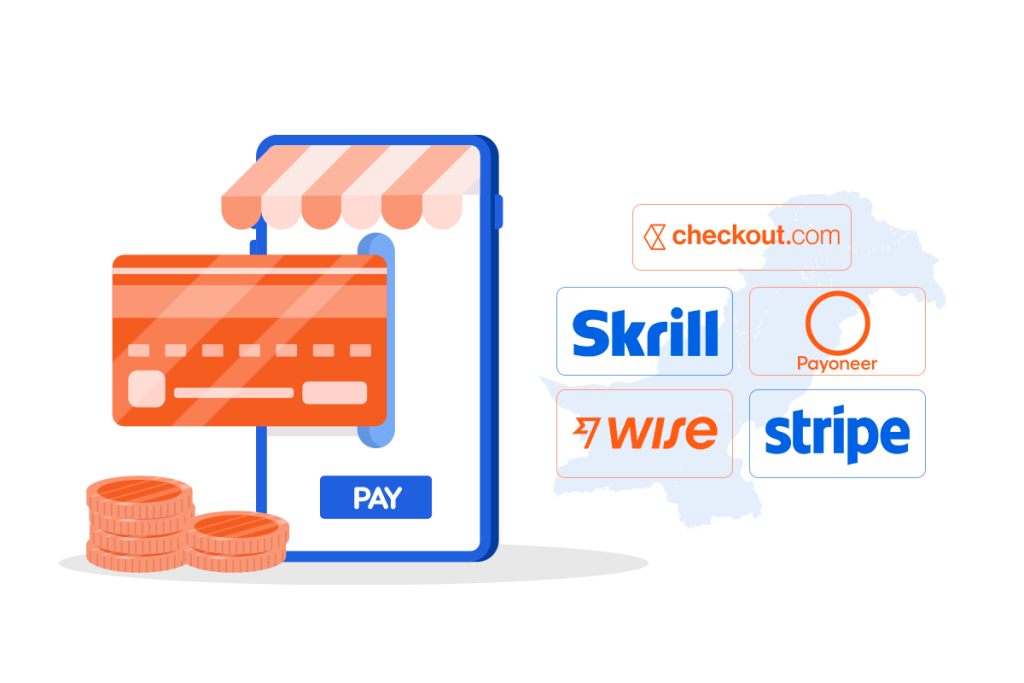

Alternatives to PayPal in Pakistan

While PayPal isn’t available in Pakistan, there are several alternatives that offer similar services for online transactions. Here are some popular alternatives:

1- Skrill

Skrill is a part of Paysafe Limited. It was established in 2001, offering digital wallet to almost 40 countries. is like multi-currency wallet. Skrill is a convenient and secure tool for managing your money online in Pakistan without any hassle of traditional banking methods.

| Founded Date | 2001 |

| Founded By | Daniel Klein, Benjamin Kullmann |

| Headquarters | London, United Kingdom |

| Services Provided | Online Payments, Digital Wallet, Money Transfers, Cryptocurrency Services |

| Ownership | Owned by Paysafe Group |

| Supported Currencies | Skrill supports over 40 currencies worldwide |

| Funding Methods | Bank Transfers, Credit/Debit Cards, Local Payment Methods |

| Partnerships | Skrill has partnerships with various merchants, online gaming platforms, and e-commerce websites |

Benefits of Skrill

Here are some of the benefits of Skrill given below.

Convenience: Skrill makes it super easy to handle your money online. With just a few clicks, you can send money to anyone with an email address or a Skrill account.

Global Transactions: One of the best things about Skrill is that it works worldwide allowing you to send and receive money internationally without any hassle.

Multiple Currency Support: Skrill operates in more than 100 countries and multiple currencies, which means you can deal with money in different parts of the world.

Secure Transactions: Skrill takes security seriously. They use advanced encryption technology to protect your financial information.

Flexibility: Skrill offers various funding options, including bank transfers, credit/debit cards, and other local payment methods.

Low Fees: Compared to traditional banking methods, Skrill often charges lower fees for international transactions.

2- Payoneer

Payoneer was founded in 2005, specializing in cross border B2B payments. It helps the account holders to send and receive money using e-wallet. Many big companies including Amazon, Google and Upwork use Payoneer for money transactions. Whether you’re a freelancer, an online seller, or just someone who needs to send or receive money internationally, Payoneer makes it easy to manage your finances wherever you are.

| Founded Date | 2005 |

| Founded By | Yuval Tal |

| Headquarters | New York City, United States |

| Services Provided | Global Payments, Currency Conversion, Freelancer Payments, Online Seller Payments |

| Number of Users | Over 4 million |

| Countries Supported | Payoneer operates in over 150 countries and territories, supporting multiple currencies and languages |

| Notable Partnerships | Payoneer has partnerships with major e-commerce platforms, freelance marketplaces, and payment gateways such as Amazon, Upwork, and Fiverr |

Benefits of Payoneer

Here are some of the benefits of Payoneer given below.

Global Reach: One of the coolest things about Payoneer is that it works worldwide. Payoneer makes it easy to get paid.

Currency Conversion: Payoneer supports more than 150 cross border currencies, so you can receive payments in different currencies and convert them to your local currency.

Low Fees: Payoneer charges lower fees compared to traditional banking methods for international transactions.

Security: Payoneer takes security seriously. They use advanced encryption technology to keep your financial information safe and secure.

Flexible Payment Options: With Payoneer, you have the flexibility to choose how you want to receive your payments.

3- Stripe

Stripe was founded in 2009. It is an Irish-American company in South San Francisco, California, founded by two Irish brothers John and Patrick Collison. It helps companies accept payments over the internet in an easy and secure way. The company’s main focus is to offer application programming interfaces and payment software for e-commerce websites as well as mobile applications.

| Founded Date | 2009 |

| Founders | Patrick Collison, John Collison |

| Headquarters | San Francisco, California, United States |

| Services Provided | Online Payment Processing, Subscription Management |

| Payment Methods | Credit/Debit Cards, Digital Wallets, Cryptocurrency |

| Global Presence | Operates in multiple countries worldwide |

| Notable Clients | Shopify, Lyft, Slack, Under Armour |

Benefits of Stripe

Here are some of the benefits of Stripe given below.

Easy Integration: Stripe’s developer-friendly platform allows businesses to integrate payment processing into their websites or mobile apps quickly and with minimal effort.

Flexible Payment Options: Stripe supports various payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, and even cryptocurrencies.

Subscription Management: For businesses offering subscription-based services, Stripe provides tools for managing subscriptions, billing cycles, and customer invoices

Global Reach: Stripe operates globally. With support for multiple currencies and languages, businesses can expand their reach and tap into new markets effortlessly.

Secure Transactions: Security is a top priority for Stripe. The platform employs advanced encryption techniques to protect sensitive payment information.

Fast Payouts: Stripe offers fast payout options, allowing businesses to access their funds quickly after a successful transaction.

Scalability: Whether a business is just starting or experiencing rapid growth, Stripe scales seamlessly to meet their evolving payment needs.

4- TransferWise

TransferWise founded in 2011, now known as Wise, specializes in international money transfers with low fees and competitive exchange rates. It’s suitable for individuals and businesses alike. TransferWise helps people and businesses transfer money between different countries quickly and affordably. It matches your transfer with people sending money in the opposite direction. This way, your money doesn’t actually cross borders, which helps to avoid hefty international transfer fees.

| Founders | Taavet Hinrikus, Kristo Kaarmann |

| Headquarters | London, United Kingdom |

| Founded in | 2011 |

| Services Provided | International Money Transfers, Multi-Currency Accounts, Borderless Accounts |

| Currencies Supported | 50+ Currencies |

Benefits of TransferWise

Here are some of the benefits of Stripe given below.

Supported Currencies: TransferWise supports over 50 currencies, making it easy to send money to most countries around the world.

Fees: TransferWise charges low and transparent fees, typically much lower than traditional banks. They show you exactly how much you’ll pay upfront, so there are no surprises.

Speed: TransferWise offers fast transfers in many currency routes. Some transfers can even be completed within minutes, while others may take a few business days, depending on the currency and destination.

Authorized Platform: TransferWise is authorized and regulated by financial authorities in different countries, ensuring that your money is handled securely.

User-Friendly: TransferWise’s online platform and mobile app are user-friendly, making it easy for anyone to send money internationally with just a few clicks.

Trusted by Millions: TransferWise has millions of customers worldwide who trust the service for their international money transfer needs.

5- 2Checkout

2Checkout was founded in 2006 by Alan Homewood and Mark McGregor. Its headquarters are located in Atlanta, Georgia, United States. The company offers online payment processing services, e-commerce solutions, and subscription billing services to businesses of all sizes. The company has enabled 10 billion secure transactions every year. It’s particularly popular among e-commerce businesses.

| Founders | Alan Homewood, Mark McGregor |

| Headquarters | Atlanta, Georgia, United States |

| Founded in | 2006 |

| Services Provided | Online Payment Processing, E-commerce Solutions, Subscription Billing |

| Payment Methods | Credit/Debit Cards, PayPal, Bank Transfers, Local Payment Methods |

| Supported Currencies | 87 Currencies |

| Notable Clients | Shopify, Mailchimp, GetResponse, Kaspersky |

| Parent Company | Verifone |

Benefits of 2Checkout

Multiple Payment Methods: 2Checkout supports various payment methods, including credit/debit cards, PayPal, bank transfers, and local payment methods, providing flexibility for customers.

Security and Safety: 2Checkout prioritizes security and compliance with industry standards, ensuring that customer payment information is protected during transactions.

Easy Integration: Businesses can easily integrate 2Checkout into their websites or online stores with minimal effort, allowing them to start accepting payments quickly.

Subscription Billing: 2Checkout offers subscription billing services, allowing businesses to set up and manage payments for subscription-based products or services.

Notable Clients: With reputable clients such as Shopify and Mailchimp, businesses can trust 2Checkout for their online payment processing needs.

Final Words

While creating a PayPal account in Pakistan may require some extra steps due to restrictions, it’s still possible to access its services using a VPN. However, if you encounter difficulties or prefer alternatives, there are several other reliable payment platforms to choose from. Whether you choose Skrill, Payoneer, TransferWise, or other alternatives, each platform offers its own set of benefits and features to meet your online payment needs. Consider your specific needs and preferences when selecting the right payment solution for your requirements.