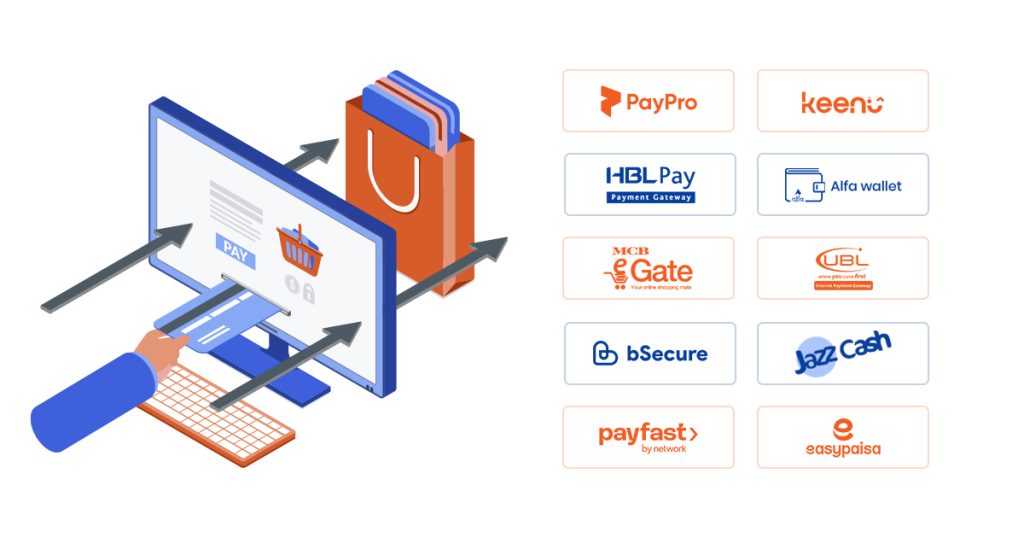

In the recent years, the way of shopping has been transformed a lot especially in Pakistan. With the rise of e-Commerce more and more Pakistanis are choosing to shop online for everything. This big shift has made it essential for businesses to adopt the digital payment solutions that allows the customers to pay easily and securely from the comfort of their own homes.In this article we will get into the details of 10 best payment gateways that are available in Pakistan. We have divided into two main categories: gateways operated by banks and fintech companies. Each of them offers unique features that can cater to the different types of businesses. Let’s explore these options so you can make a more informed decision for your business’s online payment needs.

What is a Payment Gateway?

A payment gateway is something that facilitates online payment for products and services. It acts as an intermediate source between customer and the seller. This allows the customers to pay through different methods such as debit cards, credit cards, mobile wallets & bank transfers, enhancing their overall shopping experience. Payment gateways ensures that the transactions are processed smoothly and securely. They ensure that the sensitive financial information is kept safe.

The State Bank of Pakistan (SBP) has launched an innovative online payment system for merchants through Raast. Check out the top10 payment gateways in Pakistan that facilitate seamless online checkout integration.

Payment Gateways Operated Under Banks

Here are the following trusted payment gateways that are operated by established banks in Pakistan. These platforms provide reliable and secure options for online transactions. People trust more on these types of payment gateways.

| Sr. | Online Payment Gateway | Bank Name |

| 1 | HBLPay Checkout | Habib Bank Limited |

| 2 | Alfa Payment Gateway | Alfa-Bank |

| 3 | MCB eGate Payment Gateway | Muslim Commercial Bank |

| 4 | UBL e-Commerce Payment Gateway | United Bank Limited |

HBLPay Checkout

HBLPay Checkout is an online payment solution that is offered by Habib Bank Limited (HBL), one of the largest and most trusted banks in Pakistan. As more and more businesses in Pakistan are moving online so HBLPay provides a great platform that helps merchants to accept payments securely and efficiently. This gateway combines security, flexibility, and ease of use. With its range of payment options and the user-friendly interface, it is an excellent choice for all those businesses that are looking to enhance their online payment process.

Features and Benefits

Here is a detailed look at what HBLPay Checkout offers to its customers:

- It has a strong focus on security. All the card details and personal information are encrypted.

- HBLPay Checkout supports a variety of payment methods such as credit & debit cards, mobile wallets, and bank transfers.

- It has easy integration into your online store. The bank provides detailed documentation and support for implementing it.

- It has seamless checkout experience that is simple and user-friendly with minimal steps.

- HBLPay processes transactions in real time. Once a payment is done, both seller and customer receive instant notifications.

- Merchants can view details about sales, refunds, and payment statuses all in one place.

- In case of any issues or queries, HBLPay provides customer support. Businesses can reach them for assistance in technical problems & payment queries.

Alfa Payment Gateway

Alfa Payment Gateway is designed specifically to cater to the evolving needs of businesses and the customers in Pakistan’s digital economy. It stands out due to its unique features like mobile wallet integration and installment plans. By choosing Alfa, you are not only streamlining your payment operations but also fostering the customer loyalty through flexibility and support.

Features and Benefits

Here is a detailed look at what HBLPay Checkout offers to its customers:

- In addition to the traditional credit and debit card payments, it supports mobile wallet option too.

- This gateway is more convenient for those who frequently use their smart phones for transactions.

- For the businesses it allows for immediate order processing and helps them to manage inventory more effectively.

- Alfa Payment Gateway allows businesses to offer installment payment plants to customers.

- Customers can make larger purchases without the burden of paying the full amount on the spot. This flexibility can increase the sales.

- Merchants can analyze their sales performance through comprehensive analytics tools.

- It offers easy access to transaction history, sales reports, and customer data.

- Bank Alfalah provides hands-on training sessions to help businesses understand how to make the most of the gateway’s features.

- Alfa Payment Gateway adheres to international security standards.

MCB eGate Payment Gateway

MCB eGate is an online payment solution that is provided by Muslim Commercial Bank (MCB). MCB is one of the Pakistan’s oldest and most trusted banks. Designed to facilitate the online transactions, MCB eGate is a secure payment gateway that helps businesses of all sizes to enhance their eCommerce capabilities. By choosing MCB eGate, businesses can provide a seamless shopping experience for their customers and can ultimately drive sales and build trust.

Features and Benefits

Here is a detailed look at what HBLPay Checkout offers to its customers:

- When a payment is done, the transaction is completed instantly and processed in real time without delays.

- By offering a variety of payment options, MCB eGate helps businesses cater to a diverse customer base.

- Their simple checkout process enhances the overall shopping experience, encouraging repeat business.

- Security is a top priority for MCB eGate. It uses advanced encryption technologies to protect sensitive customer information during transactions.Businesses can access analytics that provide insights into sales trends, payment statuses, and customer behavior through it.

- MCB eGate offers customizable solutions tailored to specific business requirements and sizes.

How is Pakistan leading the way in digital payments within South Asia? Discover how Pakistan is pioneering digital payments in the region.

UBL e-Commerce Payment Gateway

The UBL e-Commerce payment gateway is a comprehensive payment solution that is designed to support businesses in accepting online payments smoothly and securely. By using the UBL’s gateway, businesses can accept payments with confidence, knowing that they are backed up by a reliable bank that has global reach and a strong customer support. It is popular for its reliability and several unique features that set it apart from other options in the market.

Features and Benefits

Here is a detailed look at what HBLPay Checkout offers to its customers:

- Unlike many local payment gateways, UBL e-Commerce Payment Gateway accepts payments not just from local customers but also from international ones.

- It offers simple integration with a wide range of e-commerce platforms, such as Magento, Shopify, and WooCommerce.

- One of the unique features of UBL e-Commerce Payment Gateway is its ability to support multi-currency payments.

- Customers can pay in their preferred currency through UBL, which adds convenience and encourages more international sales.UBL e-Commerce Payment Gateway is equipped with advanced fraud detection systems.

- Whether a business requires a simple checkout process or a more complex payment structure with additional features, UBL e-Commerce Payment Gateway can be customized according to their choice.

- UBL e-Commerce Payment Gateway offers the round-the-clock customer support offered by the bank.

Looking for reliable banking options that align with your faith? Here are 7 leading Islamic banks in Pakistan offering the best Shariah-compliant banking services.

Payment Gateways Operated by Fintech Companies

Explore these reliable payment gateways operated by fintech companies in Pakistan. These platforms focus on modern solutions to streamline online payments. They operate independently but fewer people trust on them in comparison to those that are operated under banks.

| Sr. | Online Payment Gateway |

| 1 | JazzCash Payment Gateway |

| 2 | Secure Payment Gateway |

| 3 | PayFast Payment Gateway |

| 4 | EasyPaisa Payment Gateway |

| 5 | PayPro Payment Gateway |

JazzCash Payment Gateway

JazzCash is one of the Pakistan’s most popular mobile wallets and digital payment platforms. It offers a secure and efficient payment service that allows to accept a variety of payments online. With its widespread use and user-friendly interface. JazzCash is a top choice for businesses in Pakistan.

Features and Benefits

Here is a detailed look at what JazzCash Payment Gateway offers to its customers:

- JazzCash is known for its extensive user base, with millions of active users across Pakistan.

- JazzCash provides integration guides and support, making the process simple and hassle-free, even for small businesses with limited resources.

- There are no high upfront costs to integrate the payment gateway, and JazzCash operates on a transaction fee model, meaning businesses only pay a small percentage per transaction.

- Since it is a mobile wallet, customers can use it even if they don’t have a bank account, which is particularly beneficial for reaching rural areas.

- JazzCash offers businesses additional services such as bill payments and mobile top-ups.

- More than just a standard checkout option businesses in the utility or telecommunications sector can allow customers to pay bills or recharge their mobile credits directly through the JazzCash platform.

- JazzCash is also PCI-DSS compliant. It ensures that all transactions meet international security standards.

bSecure

bSecure is an emerging payment gateway in Pakistan. It is designed to make online payments easy, fast, and secure for both the businesses and the customers. The main focus of bSecure is to simplify the checkout process. It offers a smooth and hassle-free experience for everyone involved. Whether you are running a small business or a large online store, you can choose it to get access to a wide range of options.

Features and Benefits

Here is a detailed look at what bSecure Payment Gateway offers to its customers

- Create your own e-stores in just 5 minutes and get the payments from all the major and renowned banks.

- Get exclusive discounts and track sales all at one place.

- On VISA or MasterCard, get special discounts. Create custom BIN Codes according to your choice.

- bSecure Robo Call options ensures order confirmations before delivering the products.

- It also offers Urdu Checkout options for the customers, adding convenience and better communication.

- Create delivery zones of your own choice from store settings.

- You can track, void, and refund your order all at single portal rather than wandering from one page to another.

Curious about Elevate Bank’s presence in Pakistan? Here’s how to open a USD account with Elevate Bank in Pakistan.

PayFast

PayFast is a reliable payment gateway in Pakistan that makes the online transactions simple for both businesses and the customers. It is designed to handle online payments, both locally and internationally. You can get a variety of payment methods here, including credit & debit cards, mobile wallets, and the bank transfers. By offering such a wide variety of payment options, businesses can expand to a broader audience and can make the payment process easier for their customers

Features and Benefits

Here is a detailed look at what PayFast Payment Gateway offers to its customers:

- It enables its users, 18+ payment methods. With PayFast, you can schedule your payments at regular intervals.

- Once you have received your payment in almost any currency, with PayFast, split it to the 3rd party immediately.

- You can also accept payments through emails.

- You can refund your customers directly, without long and tiring processes.

- Allow your customers to pay all the invoices online.

- Sell the events tickets online through PayFast.

- The platform offers reduced fees for its operation, so raise funds online and get benefited.

EasyPaisa Payment Gateway

EasyPaisa is one of the Pakistan’s most widely used digital wallets and mobile banking services. It is a trusted option for both customers and the businesses. Launched by Telenor, EasyPaisa has evolved into a full-fledged payment gateway. It allows businesses to accept a wide range of online payments, including mobile wallet transfers, credit/debit cards, and direct bank transactions. With millions of users already using EasyPaisa for everyday transactions, it offers businesses an excellent way to tap into a larger customer base.

Features and Benefits

Here is a detailed look at what EasyPaisa Gateway offers to its customers:

- The platform boosts 10.5 million+ active users monthly.

- Every year, 24 million+ online transactions are done through it.

- EasyPaisa annual online throughput is PKR 14 billion+.

- Boosts a dedicated merchant portal to keep track of your payments.

- EasyPaisa is known for processing payments instantly. As soon as a customer makes a payment, the transaction is completed within seconds, and businesses receive real-time notifications.

- This payment gateway uses advanced encryption and fraud detection technologies to ensure that all transactions are safe and secure.

- One of the key advantages of EasyPaisa for businesses is its affordable pricing structure.

- There are no hefty setup fees, and the platform charges a low percentage per transaction.

- Its association with Telenor gives it an additional layer of credibility.

Keenu Payment Gateway

Keenu is a famous online payment gateway in Pakistan. Whether you are running an e-commerce store or providing your services online, Keenu allows your customers to pay using various methods like debit cards, credit cards, mobile wallets, or even you can do in-person transactions. It is a simple and user-friendly platform. Keenu makes it easier for businesses to manage their payments and for customers to enjoy a smooth checkout experience.

Features and Benefits

Here is a detailed look at what Keenu Payment Gateway offers to its customers:

- It provides developer friendly integrations and plugins for all types of payments.

- The platforms offer loyalty and reward programs to its users.

- Must faster transaction time and simple to use interface.

- Extremely supportive customer team.

- One of Keenu’s standout features is its ability to provide businesses with detailed reports on their sales and transactions.

- Keenu provides businesses with a customizable checkout page, allowing them to match the payment experience with their brand identity (Branding).

- For businesses looking to keep costs low, Keenu offers a cost-effective solution by not charging any upfront setup fees.

PayPro Payment Gateway

PayPro is a modern and trusted payment gateway in Pakistan. It is designed to streamline the way, business handle payments. It offers a wide range of features that helps businesses of all sizes to collect payments efficiently without any setup cost.

Features and Benefits

Here is a detailed look at what Keenu Payment Gateway offers to its customers:

- One of the key strengths of PayPro is its versatility in accepting payments

- Businesses can add PayPro to their online stores without complicated setup processes.

- PayPro provides step-by-step instructions and support to ensure that merchants can start accepting payments quickly without hassle.

- One of the standout features of PayPro is its user-friendly dashboard. Businesses can track all their transactions in one place.

- PayPro offers an automatic payment reminder feature, which is especially useful for businesses that deal with recurring payments or overdue invoices

- PayPro has no setup costs, making it an attractive option for startups and small businesses with limited budgets.

- It is PCI-DSS compliant, which means that it adheres to strict international standards for data security.

Looking to enhance your international banking experience? Elevate your international transactions with these top 6 banks in Pakistan.

10 Reliable Payment Gateways to Simplify Online Transactions in Pakistan

Discover 10 trusted payment gateways that make online transactions easier and more secure for businesses in Pakistan. These platforms offer a variety of options to help customers pay smoothly and safely.

| Sr. No. | Payment Gateway | Contact no. |

| 1 | HBL | 021-111 111 425 |

| 2 | Bank Alfalah | 042 111 225 111 |

| 3 | MCB Bank | 042-35987695 |

| 4 | UBL | 0221-111-825-888. |

| 5 | JazzCash | 021-111-124-444 |

| 6 | bSecure | +92-21-35155441-5 |

| 7 | PayFast | 021-37133278 |

| 8 | EasyPaisa | 021-111-003-737 |

| 9 | Keenu | 021-111-153-368. |

| 10 | PayPro | 02 322 9555999 |

Final Words

Choosing the right payment gateway is important for any business that is looking to offer a smooth and secure online shopping experience. Pakistan has a growing number of reliable payment gateways that cater to different business needs. Make sure to assess your business needs, budget, and target audience to choose the best payment gateway for your online store.